What is whole life insurance?

Whole life insurance is permanent life insurance protection that lasts your entire life; by contrast, term life insurance only covers you for a specific number of years. While there are other kinds of permanent coverage, whole life is the simplest.

Whole Life Insurance: How it Works Explained

When you first purchase whole life insurance, the premium payments for the policy will likely be higher than premiums for a term policy with the same amount of coverage. That’s because the premium is a set amount for the life of the policy. However, if you purchased a term life policy and renewed it later in life, the premiums for the renewed policy would likely be more than what you would continue to pay on the whole life insurance policy.

Whole life insurance has a cash savings component. Because it builds up a tax-deferred cash value over the life of the policy, you can borrow against the cash value of the policy if needed. The accrued cash value depends on the amount of your premiums minus expenses and other charges implemented by your life insurance company.

If you do withdraw some of the cash value in your whole life policy, it will reduce the death benefit paid to your beneficiaries. If you withdraw the entire cash value, your policy will be canceled.

You also may have the option of taking out a loan against the cash value of your whole life policy. The loan will accrue interest until it’s paid off. You can choose to pay off the loan yourself or wait and have the loan paid off with funds from your death benefit.

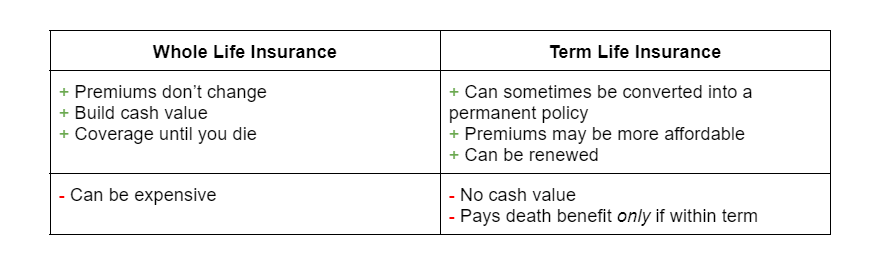

Whole Life vs. Term Life Insurance

As previously stated, whole life insurance pays a specific death benefit upon your death regardless of when that occurs, so long as the premiums are paid as agreed. Over the life of the policy, you also build up a tax-deferred cash value you may borrow against.

As the name implies, term life insurance coverage is adequate for a specific length of time—for example, five, 10, 20 years, or longer. The death benefit is only paid if you die during this term. If the term expires, you may be able to renew the policy, although the premiums may increase.

Term insurance does not build up any cash value, unlike whole life insurance. However, some term policies can be renewed or converted into permanent life insurance policies, such as a whole life policy.

Who should consider whole life insurance?

Evaluating your financial situation is key to determining if you need whole life insurance.

Here are some questions to consider:

- Is your family reliant on your current income to pay their living expenses?

- Will you need funds to cover your final expenses and any estate taxes?

- Will your children need money to pay for college?

If the answer to these questions is “yes,” a whole life insurance policy may be right for you.

Find the Best Life Insurance for You

Shopping for whole life insurance can start online, but you likely will need to speak to an insurance agent to complete the purchase. The life insurance company will need personal information such as your age, gender, occupation, and health condition.